Unlike day traders, swing merchants are less involved with intraday market fluctuations as a result of they’re looking for bigger movements over a more prolonged period.

It isn’t a solicitation or a advice to trade derivatives contracts or securities and should not be construed or interpreted as monetary recommendation. DailyFX Limited just isn’t responsible for any trading decisions taken by individuals not intended to view this material. Below is an example of a day by day chart sometimes used by a position dealer, displaying an extended position and an exit greater than two months later, once more primarily based on RSI signals circled on the chart.

Swing Trading

Copy traders are foreign exchange merchants who copy the trades of different profitable merchants. They use social trading platforms to search out merchants with a great observe report and duplicate their trades mechanically. Copy traders depend on the expertise of different merchants and don’t have to have extensive knowledge of the foreign exchange market. In conclusion, the sort of buying and selling a person chooses is dependent upon their character, available time, capital, and stage of expertise within the markets.

These folks use totally different methods, software, and online platforms for their actions. You would possibly want to think about place buying and selling if you’re in an expert subject that leaves you little to no time to actively trade. With position trading, you’ll find a way to merely make your chart evaluation as soon as a day, on the finish of every buying and selling day.

These merchants typically take a short-term outlook however would possibly name sure occasions as major market turning points as good alerts to enter or exit a long-term commerce. They analyse news, earnings stories, economic data, and company occasions to anticipate worth actions. These merchants search to revenue from market reactions to events, similar to mergers, earnings surprises, or geopolitical developments.

pattern evaluation to establish potential trades. Position merchants are traders who maintain positions for a longer period of time, typically a quantity of weeks or months, in the international trade market. Swing merchants

Kinds Of Orders Traders Use To Trade Shares

There is not any one-size-fits-all solution in trading, and the key to long-term success lies in self-awareness, steady learning, and adaptation. By understanding and embracing your most popular method, you can create a sustainable and constant plan that will increase your probabilities of success within the markets. Traders profit extra with much less threat however require a deeper understanding of methods and studying tendencies properly. Scalping

one thing for everybody. Unlike stocks and different funding instruments, the small movements in several any forex in foreign exchange are best for leveraged buying and selling.

Swing Traders:

Success, for a day dealer, means ending the day with no open positions and a revenue relative to the beginning of the session. This sort of trading often appeals to individuals who deal in high-volume shares and who have a radical grasp of worth analysis. It contains exploiting numerous value gaps caused by order flows

Forex trading, also called overseas exchange buying and selling, is a decentralized global market the place merchants can purchase, promote, and exchange currencies. It is the biggest and most liquid financial market in the world, with an estimated day by day buying and selling volume of over $6 trillion. Forex buying and selling can be a lucrative investment alternative, however it also carries important dangers https://www.xcritical.com/. In this beginner’s guide, we’ll explore the different varieties of foreign forex trading that can help you perceive which one fits your trading style and targets. They make greater returns than a ‘purchase & maintain’ investor while having decrease threat compared to the other buying and selling kinds. There’s additionally no want for Swing traders to look at the market in real-time.

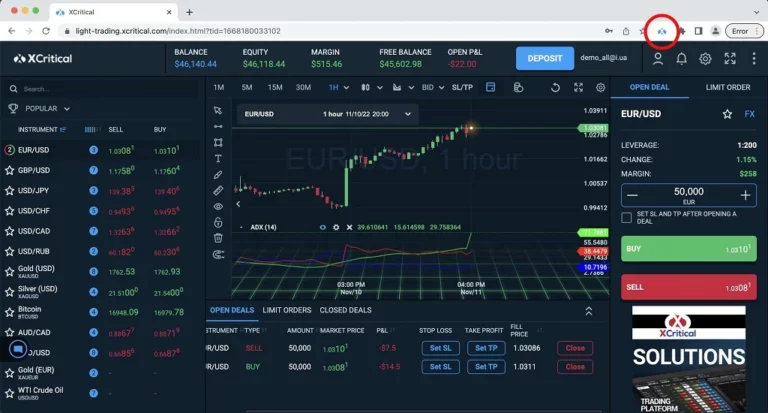

Day traders are traders who purchase and sell currencies throughout the same buying and selling day, with the goal desktop trading terminal of creating small income from the short-term price actions. They often close

Scalpers usually hold positions for a quantity of seconds to a couple minutes and depend on technical analysis to establish entry and exit factors. Scalping is a foreign foreign money trading type involving specializing in taking benefit of tiny price changes and making fast profits from reselling. Scalpers will have to have a strict exit strategy because a big loss could wash away the small gains.

Technical merchants rely on charts, patterns, and technical indicators to research historical price knowledge and predict future price movements. They believe that historical worth patterns repeat themselves and use numerous tools, corresponding to shifting averages, oscillators, and trendlines, to identify purchase or promote alerts. Technical traders typically employ totally different charting strategies, such as candlestick patterns and Fibonacci retracements, to reinforce their trading decisions.

Which Era Frame Is Right?

Forex trading has become increasingly well-liked through the years and has attracted different sorts of traders who’ve different buying and selling types and strategies. Day buying and selling is probably essentially the most well-known type of energetic buying and selling, the place traders buy and sell securities inside the similar trading day. Positions are closed out throughout the same day they’re taken, and nothing is held overnight.

These are market participants that will usually keep away from holding something after the session shut and will trade in a high-volume trend. Day traders often decide a side at the beginning of the day, appearing on their bias, after which ending the day with both a profit or a loss. Scalping is essentially the most worthwhile forex technique for having various trading alternatives, an improved success fee, and minute systematic risk. However, success is dependent upon consistency and being delicate to slippage.

- In addition, day merchants tend to rely extra on technical buying and selling patterns and risky pairs to make their profits.

- They analyse news, earnings reports, economic knowledge, and corporate events to anticipate worth movements.

- Scalpers are

- A profitable day for these merchants is one with out open positions having a price relative to the start of the session.

- stop-loss orders to restrict potential losses on their trades but since the trade

These factors are based on Relative Strength Index (RSI) indicators, with the oversold and overbought areas circled on the chart. Position trading is a long-term approach the place merchants hold positions for weeks, months, or even years, aiming to capitalize on important worth developments. Leveraged trading in foreign forex or off-exchange products on margin carries important danger and will not be appropriate for all investors. We advise you to fastidiously consider whether or not buying and selling is suitable for you based mostly in your private circumstances. We recommend that you simply search impartial advice and make sure you fully perceive the risks concerned before buying and selling. Information presented by DailyFX Limited should be construed as market commentary, merely observing economical, political and market conditions.

Forex day trading is shopping for and promoting currencies inside a buying and selling day without any positions operating overnight. These merchants buy and sell currency pairs every day to benefit from small market adjustments. While their routine won’t be as fast-paced as a scalper’s, day traders will equally shut all positions before the top of the buying and selling day, in order not to hold any in a single day.

About The Author: Adrian

More posts by adrian